In the world of exchange-traded funds (ETFs), VOO and VTI stand out as two of the most popular options for investors. These ETFs have become synonymous with diversification, low-cost investing, and long-term growth potential. If you're looking to grow your wealth through index investing, understanding VOO and VTI is essential.

Investors often find themselves comparing VOO vs. VTI, as both offer unique advantages depending on your financial goals. While they share similarities, such as being passively managed and tracking broad market indices, their differences can significantly impact your portfolio's performance.

In this article, we will delve deep into the characteristics of VOO and VTI, explore their similarities and differences, and provide actionable insights to help you make informed investment decisions. Whether you're a beginner or an experienced investor, this guide will equip you with the knowledge you need to decide which ETF aligns best with your investment strategy.

Read also:Pining For Kim Tailblazer A Comprehensive Guide To Understanding Her Impact On Fashion And Pop Culture

Before we dive into the details, here's a quick overview of the article's structure to help you navigate:

Table of Contents

- What is VOO?

- What is VTI?

- VOO vs. VTI: Key Differences

- Similarities Between VOO and VTI

- Performance Analysis

- Expense Ratios and Fees

- Diversification and Market Exposure

- Which ETF is Right for You?

- Tax Considerations

- Conclusion

What is VOO?

VOO, or the Vanguard S&P 500 ETF, is one of the most widely recognized ETFs in the investment world. Launched in 2010, VOO is designed to track the performance of the S&P 500 Index, which includes 500 of the largest publicly traded companies in the United States. This ETF offers investors exposure to some of the most prominent and financially stable corporations, making it an attractive option for those seeking steady growth.

Key Features of VOO

- Index Tracking: VOO mirrors the performance of the S&P 500 Index, ensuring that investors benefit from the overall health of the U.S. economy's largest companies.

- Low Expense Ratio: With an expense ratio of just 0.03%, VOO is one of the cheapest ETFs available, making it a cost-effective choice for long-term investors.

- Dividend Yield: VOO pays out dividends quarterly, providing a steady stream of income for investors who prefer dividend-paying stocks.

What is VTI?

VTI, or the Vanguard Total Stock Market ETF, is another flagship offering from Vanguard. Unlike VOO, which focuses solely on the S&P 500, VTI provides broader market exposure by tracking the CRSP US Total Market Index. This index includes stocks from large-cap, mid-cap, and small-cap companies across all sectors of the U.S. economy. VTI is ideal for investors seeking comprehensive diversification within their portfolios.

Key Features of VTI

- Broad Market Exposure: VTI covers a wider range of companies compared to VOO, giving investors access to more than 3,500 U.S. stocks.

- Low Expense Ratio: Similar to VOO, VTI boasts an ultra-low expense ratio of 0.03%, ensuring that more of your investment returns stay in your pocket.

- Dividend Payments: VTI also distributes dividends quarterly, offering investors regular income while maintaining capital appreciation potential.

VOO vs. VTI: Key Differences

While VOO and VTI share many similarities, there are critical distinctions between the two ETFs that investors should consider before making a decision. Below, we highlight the primary differences:

Market Coverage

VOO focuses exclusively on the S&P 500 Index, which represents the largest and most established companies in the U.S. market. On the other hand, VTI casts a wider net by including small-cap and mid-cap companies, providing a more diversified portfolio.

Volatility

Due to its concentration on large-cap companies, VOO tends to be less volatile compared to VTI. Smaller companies, which make up a portion of VTI's holdings, can experience greater price fluctuations, potentially increasing risk for investors.

Read also:Jeremy Diamond Wife A Detailed Insight Into His Personal Life And Relationship

Similarities Between VOO and VTI

Despite their differences, VOO and VTI share several similarities that make them attractive options for index investors:

Low-Cost Structure

Both ETFs offer rock-bottom expense ratios, making them some of the most cost-efficient investment vehicles available. This low-cost structure is a key factor in maximizing investor returns over the long term.

Passive Management

VOO and VTI are both passively managed, meaning they aim to replicate the performance of their respective indices rather than outperforming them. This approach reduces management fees and aligns with the principles of index investing.

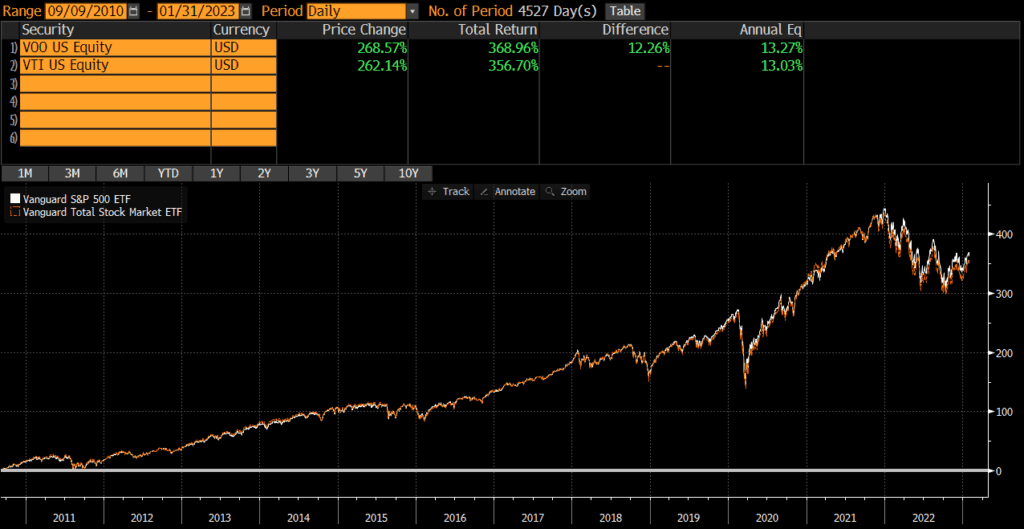

Performance Analysis

When comparing VOO vs. VTI, performance is often a top concern for investors. Historically, both ETFs have delivered strong returns, reflecting the growth of the U.S. stock market. According to data from Vanguard, both funds have achieved annualized returns of approximately 10% over the past decade.

Historical Returns

- VOO: Average annual return of 11.5% since inception.

- VTI: Average annual return of 11.2% since inception.

While the returns are similar, VTI's broader market exposure may result in slightly higher volatility during market downturns.

Expense Ratios and Fees

One of the standout features of both VOO and VTI is their ultra-low expense ratios. At just 0.03%, these ETFs are among the cheapest options available in the market. However, it's important to note that additional fees, such as brokerage commissions, may apply depending on your investment platform.

Comparison of Fees

- VOO: Expense ratio of 0.03%.

- VTI: Expense ratio of 0.03%.

Diversification and Market Exposure

One of the primary reasons investors choose VOO or VTI is for their diversification benefits. While VOO offers exposure to 500 of the largest companies, VTI expands this coverage to over 3,500 stocks. This broader diversification can help mitigate risks associated with individual sectors or industries.

Sector Allocation

Both ETFs allocate investments across various sectors, including technology, healthcare, financials, and consumer goods. However, VTI's inclusion of small-cap and mid-cap companies adds an extra layer of diversification, potentially enhancing long-term returns.

Which ETF is Right for You?

The choice between VOO and VTI ultimately depends on your investment goals and risk tolerance. Below are some considerations to help you decide:

For Conservative Investors

If you prioritize stability and prefer exposure to large, established companies, VOO may be the better choice. Its focus on the S&P 500 Index ensures a more predictable and less volatile portfolio.

For Growth-Oriented Investors

On the other hand, if you're willing to accept slightly higher risk for the potential of greater returns, VTI's broader market exposure could align better with your objectives. Its inclusion of small-cap and mid-cap companies offers additional growth opportunities.

Tax Considerations

Taxes play a significant role in investment decisions, and both VOO and VTI are structured to minimize tax liabilities. As index ETFs, they typically generate fewer capital gains distributions compared to actively managed funds. However, it's essential to consult with a tax professional to understand the specific implications for your personal situation.

Capital Gains

Both ETFs distribute capital gains annually, but the frequency and amount depend on market conditions and the underlying index's performance. Investors in higher tax brackets may want to consider holding these ETFs in tax-advantaged accounts, such as IRAs or 401(k)s.

Conclusion

VOO and VTI are two of the most compelling ETFs available today, offering investors access to the U.S. stock market at a minimal cost. While VOO focuses on the S&P 500 Index, providing exposure to the largest and most stable companies, VTI broadens the scope to include small-cap and mid-cap stocks for enhanced diversification.

Ultimately, the decision between VOO vs. VTI comes down to your investment goals and risk tolerance. For those seeking stability, VOO is an excellent choice. Conversely, investors looking for broader market exposure and potential growth may prefer VTI.

We encourage you to share your thoughts in the comments section below or explore our other articles for more insights into the world of investing. Remember, knowledge is power, and making informed decisions is key to building long-term wealth.