Boeing stock has long been a popular choice among investors looking to capitalize on the aerospace and defense sectors. As one of the largest global manufacturers of commercial airplanes, defense systems, and space exploration vehicles, Boeing offers unique opportunities for growth and stability. In this article, we will explore everything you need to know about investing in Boeing stock, from its historical performance to future prospects.

Whether you're a seasoned investor or just starting your journey in the stock market, understanding Boeing's role in the industry is crucial. This article aims to provide a thorough analysis of Boeing stock, helping you make informed decisions about your investment portfolio.

By the end of this guide, you will have a clear understanding of Boeing's financial health, market trends, and potential risks associated with investing in its stock. Let's dive in!

Read also:Rhonda Ross Kendrick The Iconic Voice That Defined An Era

Table of Contents

- Boeing Stock Overview

- A Brief History of Boeing

- Financial Performance and Stock Analysis

- Boeing's Market Position and Competitors

- Key Risks Associated with Boeing Stock

- Future Prospects and Growth Opportunities

- A Guide for Boeing Stock Investors

- Boeing Stock Dividend History

- Sustainability Initiatives and Environmental Impact

- Conclusion and Final Thoughts

Boeing Stock Overview

Boeing stock (NYSE: BA) represents ownership in The Boeing Company, one of the world's leading aerospace manufacturers and defense contractors. Founded in 1916, Boeing has grown to become a dominant player in the aviation industry, producing iconic aircraft such as the 737, 747, and 787 Dreamliner. Investors are drawn to Boeing stock due to its diversified business model and strong presence in both commercial and defense sectors.

Why Invest in Boeing Stock?

There are several reasons why Boeing stock is an attractive investment option:

- Leadership in the global aerospace industry

- Strong partnerships with airlines and governments worldwide

- Innovative technologies and research capabilities

- Potential for long-term growth as air travel demand increases

However, it is essential to weigh the risks and rewards before making any investment decisions.

A Brief History of Boeing

The Boeing Company was founded by William E. Boeing in Seattle, Washington, in 1916. Initially, the company focused on producing seaplanes and military aircraft during World War I. Over the decades, Boeing expanded its operations to include commercial airplanes, satellites, and defense systems. Today, Boeing operates in over 150 countries and employs more than 140,000 people globally.

Key Milestones in Boeing's History

- 1958: Introduction of the 707, Boeing's first jetliner

- 1970: Launch of the 747, the world's first wide-body aircraft

- 2011: Delivery of the first 787 Dreamliner

Boeing's rich history reflects its commitment to innovation and excellence in the aerospace industry.

Financial Performance and Stock Analysis

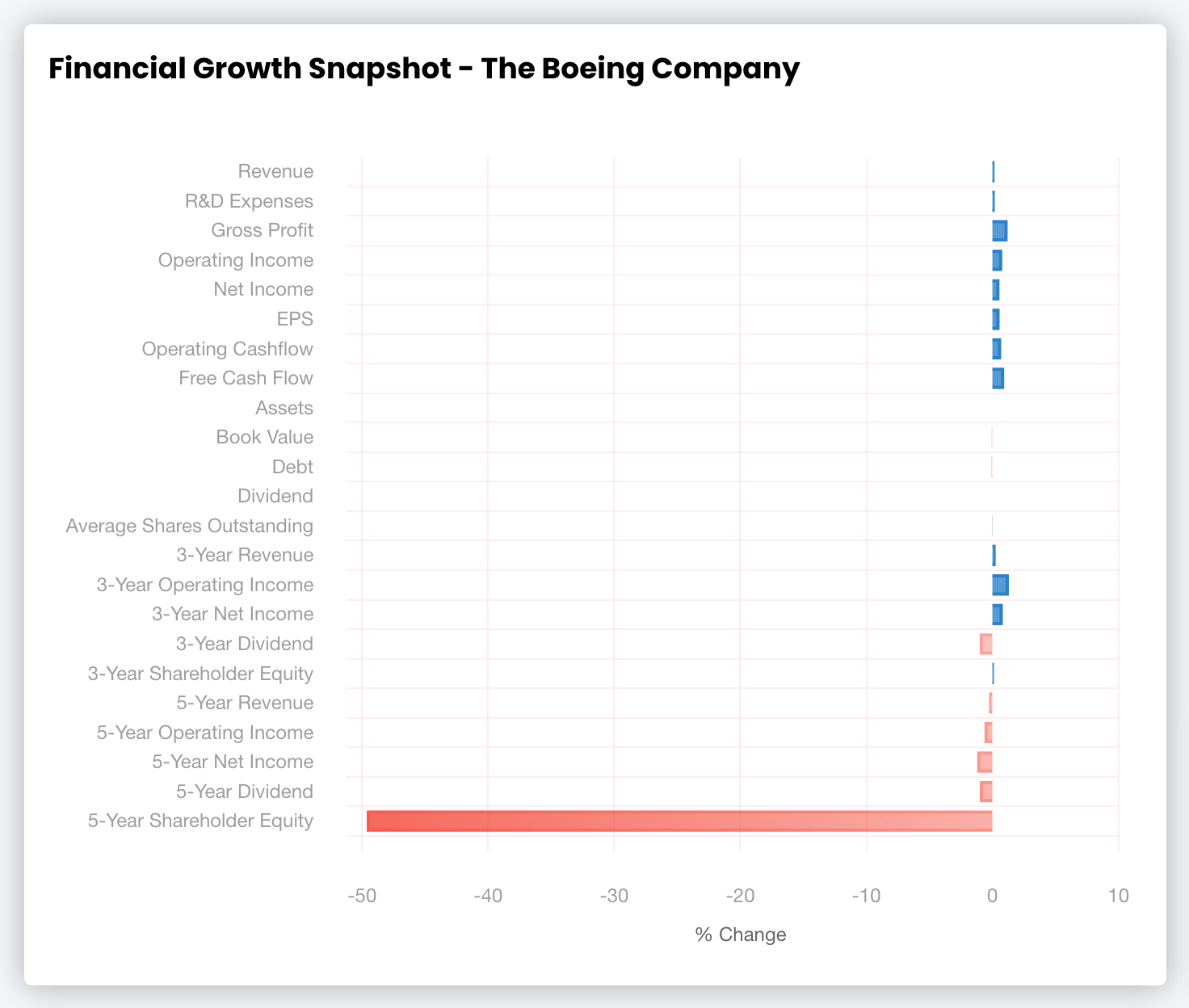

Boeing's financial performance is a critical factor for investors considering its stock. Over the years, Boeing has experienced periods of growth and challenges. In 2019, the grounding of the 737 MAX fleet due to two tragic accidents significantly impacted the company's financials. However, Boeing has taken steps to address these issues and restore investor confidence.

Read also:Juan Gabriels Wife Laura Salas A Comprehensive Look Into Their Love Story

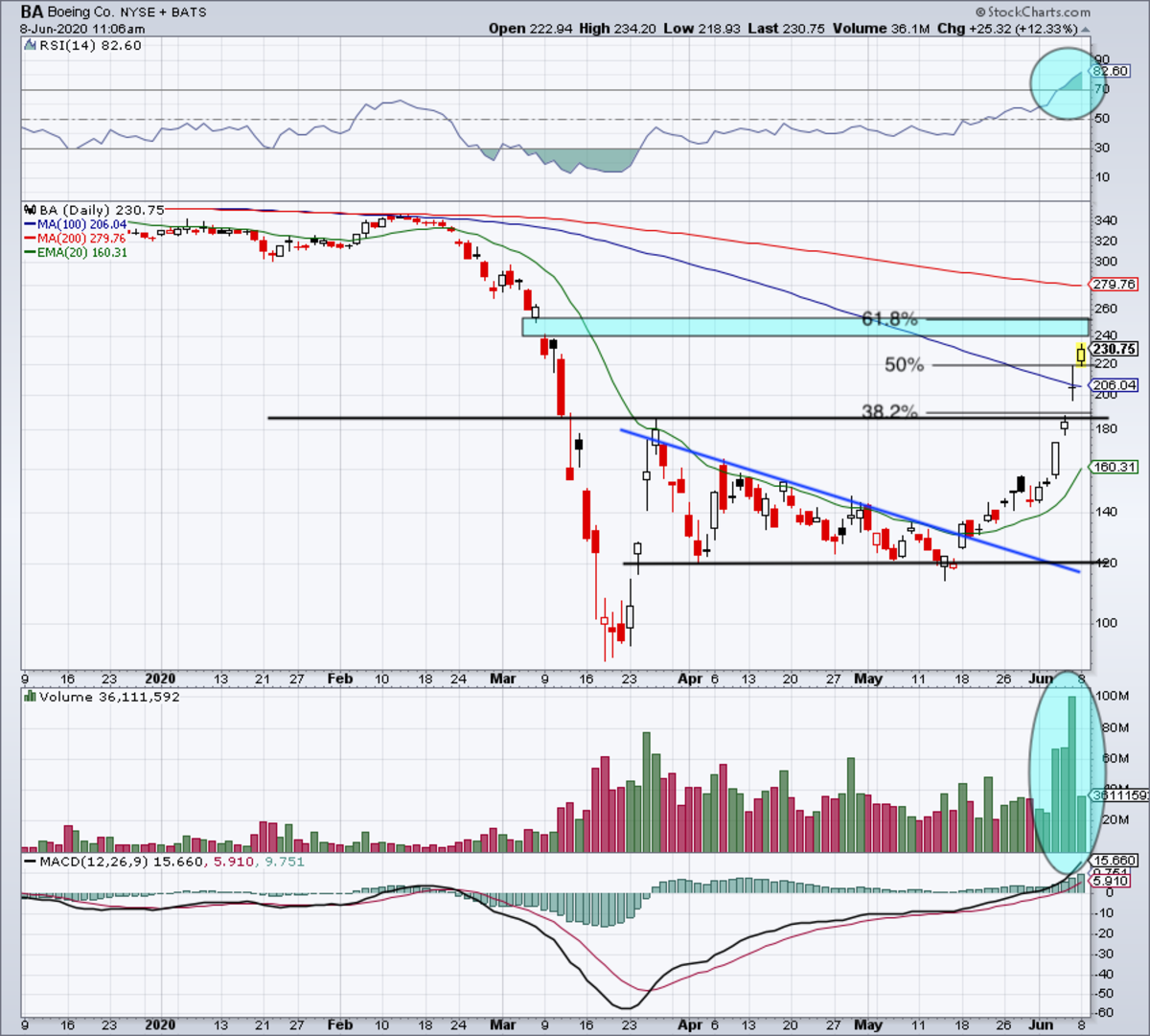

Boeing Stock Price Analysis

As of the latest data, Boeing stock has shown signs of recovery. Analysts from reputable financial institutions such as Morgan Stanley and Goldman Sachs have provided positive outlooks for Boeing's future performance. According to Bloomberg, Boeing's revenue is projected to increase as global air travel demand rebounds.

Data from Statista indicates that Boeing's revenue in 2022 was approximately $66.8 billion, reflecting a gradual improvement in its financial health.

Boeing's Market Position and Competitors

Boeing holds a significant market share in the global aerospace industry, competing primarily with Airbus. Both companies dominate the commercial aircraft market, accounting for nearly 90% of all new aircraft orders. Boeing's competitive advantage lies in its advanced technology, robust supply chain, and strong customer relationships.

Boeing vs. Airbus: A Comparison

While both companies offer similar product lines, Boeing is often favored for its innovative approach to aircraft design and production. However, Airbus has gained ground in recent years, particularly in the single-aisle aircraft segment. Investors should carefully evaluate the competitive dynamics between these two giants when considering Boeing stock.

Key Risks Associated with Boeing Stock

Investing in Boeing stock comes with inherent risks that investors must consider:

- Regulatory challenges and compliance issues

- Fluctuations in global demand for air travel

- Supply chain disruptions and material costs

- Geopolitical tensions affecting defense contracts

Despite these risks, Boeing's diversified portfolio and strong financial position provide a degree of stability for long-term investors.

Future Prospects and Growth Opportunities

Boeing is poised for growth as the global economy recovers from the impact of the pandemic. The company is investing heavily in sustainable aviation technologies and next-generation aircraft. Additionally, Boeing's defense segment continues to secure lucrative contracts with governments worldwide.

Boeing's Focus on Sustainability

As environmental concerns grow, Boeing is committed to reducing its carbon footprint. The company aims to achieve net-zero carbon emissions by 2050 through the development of sustainable aviation fuels and electric aircraft. These initiatives position Boeing as a leader in the transition to greener aviation.

A Guide for Boeing Stock Investors

Before investing in Boeing stock, it is crucial to conduct thorough research and analysis. Consider the following steps:

- Review Boeing's financial statements and earnings reports

- Analyze industry trends and competitive landscape

- Assess risk tolerance and investment horizon

- Consult with a financial advisor for personalized advice

By following these guidelines, investors can make informed decisions about adding Boeing stock to their portfolio.

Boeing Stock Dividend History

Boeing has a history of paying dividends to its shareholders, making it an attractive option for income-focused investors. However, dividend payments were suspended during the 737 MAX crisis to preserve capital. As Boeing's financial health improves, there is potential for dividend reinstatement in the future.

Dividend Yield and Payment Schedule

Historically, Boeing's dividend yield has ranged between 2% and 4%. Investors should monitor the company's dividend policy and financial performance to gauge the likelihood of future payments.

Sustainability Initiatives and Environmental Impact

Boeing is committed to addressing environmental concerns and promoting sustainable practices across its operations. The company collaborates with airlines and research institutions to develop innovative solutions for reducing carbon emissions. Additionally, Boeing invests in renewable energy projects and promotes recycling programs within its facilities.

Boeing's Sustainability Goals

- Reduce carbon emissions by 50% by 2030

- Increase use of sustainable aviation fuels

- Enhance energy efficiency in manufacturing processes

These initiatives demonstrate Boeing's dedication to environmental stewardship and long-term sustainability.

Conclusion and Final Thoughts

Boeing stock offers a compelling investment opportunity for those interested in the aerospace and defense sectors. With a rich history of innovation and a strong market position, Boeing is well-positioned for future growth. However, investors must carefully consider the risks and rewards associated with investing in Boeing stock.

We encourage readers to share their thoughts and questions in the comments section below. Additionally, explore other articles on our website for more insights into the stock market and investment strategies.