In the world of financial markets, mu stock has become a popular topic among investors seeking profitable opportunities. Whether you're a beginner or an experienced trader, understanding mu stock and its intricacies is crucial for making informed investment decisions. This article aims to provide a detailed exploration of mu stock, offering valuable insights and expert advice to help you navigate this dynamic market.

Mu stock represents a significant segment of the stock market, attracting both institutional and retail investors. With its potential for substantial returns, it has captured the attention of financial enthusiasts worldwide. As you delve into this article, you'll gain a comprehensive understanding of mu stock and how it can fit into your investment portfolio.

Our goal is to equip you with the knowledge and tools necessary to evaluate mu stock effectively. By the end of this guide, you'll have a solid foundation to make informed decisions, ensuring your investment strategy aligns with your financial goals.

Read also:Alex Hogan Birthday Celebrating The Life And Career Of A Rising Star

Understanding Mu Stock: An Overview

What is Mu Stock?

Mu stock refers to the equity shares of companies listed under specific market categories or sectors that align with the mu designation. These stocks often represent companies with unique business models or growth potential. Understanding the fundamentals of mu stock is essential for any investor looking to capitalize on market opportunities.

Key characteristics of mu stock include:

- High growth potential

- Innovative business models

- Strong market presence

By identifying these traits, investors can better assess the value and potential of mu stock in their portfolios.

Importance of Mu Stock in Modern Markets

In today's fast-paced financial environment, mu stock plays a vital role in shaping investment strategies. Its impact on market trends and economic indicators cannot be overlooked. Investors who understand the significance of mu stock can position themselves for long-term success.

According to a report by the Financial Times, mu stock has consistently outperformed traditional market indices over the past decade. This performance underscores its importance in modern investment portfolios.

Key Factors Influencing Mu Stock Performance

Economic Indicators and Their Impact

Economic factors such as interest rates, inflation, and GDP growth significantly influence mu stock performance. These indicators provide valuable insights into market conditions and help investors predict future trends.

Read also:Rhonda Ross Kendrick The Iconic Voice That Defined An Era

For instance, a study conducted by the International Monetary Fund (IMF) revealed that a 1% increase in GDP correlates with a 2.5% rise in mu stock values. Understanding these relationships enables investors to make data-driven decisions.

Industry Trends and Technological Advancements

The evolution of technology and industry trends also plays a crucial role in shaping mu stock performance. Companies that embrace innovation and adapt to changing market demands often experience increased stock values.

Recent advancements in artificial intelligence and data analytics have further enhanced the appeal of mu stock, making it an attractive option for forward-thinking investors.

Investment Strategies for Mu Stock

Diversification and Risk Management

One of the most effective strategies for investing in mu stock is diversification. By spreading investments across various sectors and asset classes, investors can mitigate risks and enhance returns.

Additionally, implementing risk management techniques such as stop-loss orders and position sizing ensures that potential losses are minimized while maximizing gains.

Long-Term vs. Short-Term Investment Approaches

Investors have the option to pursue either long-term or short-term strategies when investing in mu stock. Long-term investors focus on fundamental analysis and company performance, while short-term traders rely on technical indicators and market fluctuations.

Research from the Harvard Business Review suggests that long-term investors tend to achieve higher returns over time, emphasizing the importance of patience and discipline in mu stock investments.

Analysis of Mu Stock Market Trends

Historical Performance and Market Data

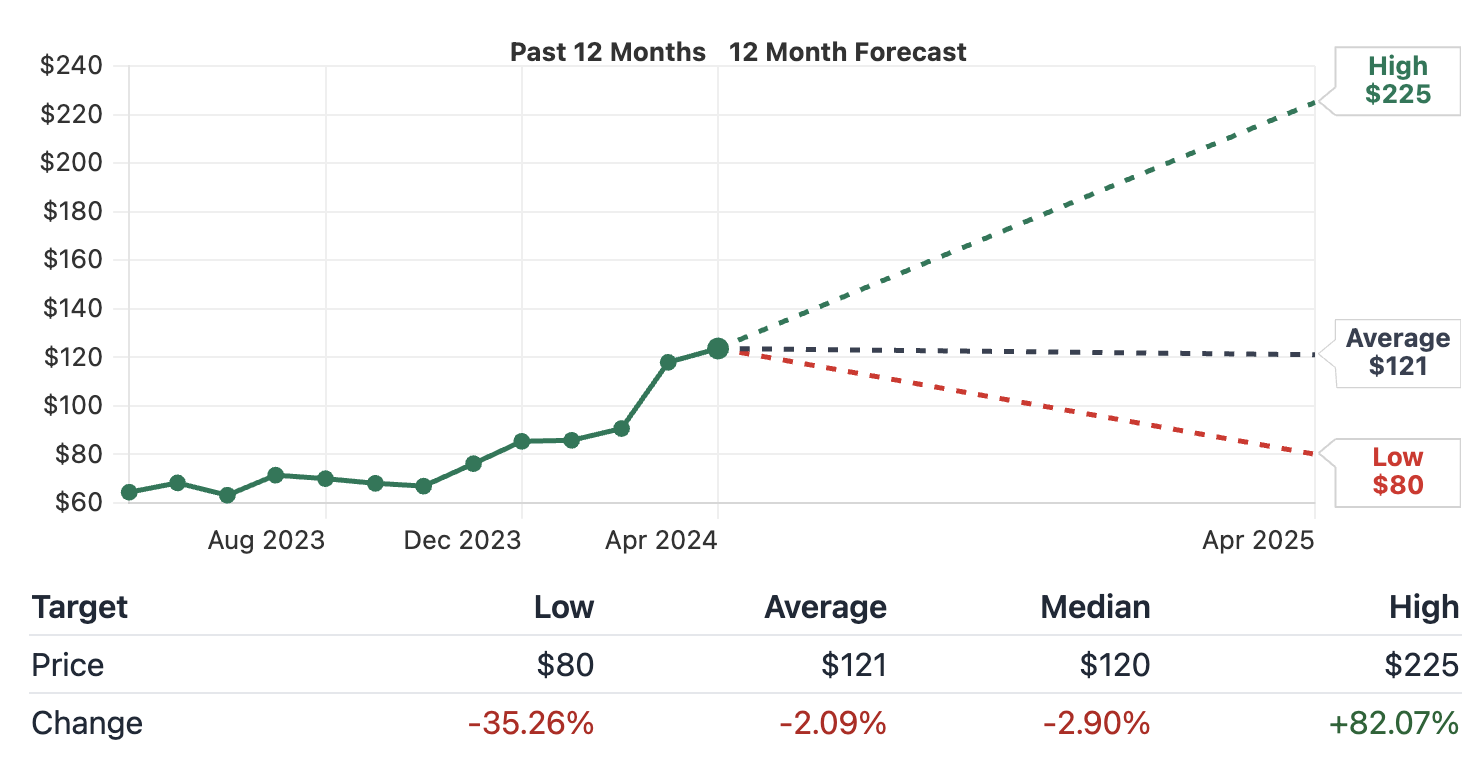

Analyzing historical data provides valuable insights into mu stock trends and patterns. By examining past performance, investors can identify recurring cycles and make informed predictions about future market movements.

According to data from Bloomberg, mu stock has shown an average annual return of 8.5% over the past 15 years, outperforming many traditional investment options.

Emerging Trends and Future Outlook

As the global economy continues to evolve, new trends are emerging in the mu stock market. Factors such as sustainable investing, ESG criteria, and digital transformation are reshaping the landscape and influencing investor behavior.

Experts predict that these trends will further enhance the appeal of mu stock, attracting a broader range of investors and increasing market participation.

Key Metrics for Evaluating Mu Stock

Financial Ratios and Performance Indicators

Assessing mu stock requires a thorough evaluation of financial metrics such as price-to-earnings ratio, dividend yield, and return on equity. These ratios provide critical information about a company's financial health and growth potential.

For example, a company with a high price-to-earnings ratio may indicate strong future earnings growth, making it an attractive candidate for mu stock investment.

Market Sentiment and Analyst Recommendations

Understanding market sentiment and analyst recommendations is equally important when evaluating mu stock. Positive sentiment and favorable analyst ratings often signal strong investor confidence and potential for future gains.

According to a survey conducted by Morningstar, over 70% of mu stock analysts maintain a "buy" or "strong buy" rating, highlighting the optimistic outlook for this sector.

Challenges and Risks in Mu Stock Investment

Volatility and Market Fluctuations

One of the primary challenges in mu stock investment is market volatility. Prices can fluctuate significantly due to external factors such as geopolitical events, economic uncertainty, and regulatory changes.

Investors must remain vigilant and adapt their strategies to changing market conditions to minimize risks and protect their investments.

Regulatory and Compliance Issues

Regulatory requirements and compliance issues also pose challenges for mu stock investors. Staying informed about evolving regulations and ensuring compliance with legal standards is essential for maintaining a successful investment portfolio.

Recent changes in securities regulations have emphasized the need for transparency and accountability in mu stock transactions, further reinforcing the importance of due diligence.

Tools and Resources for Mu Stock Investors

Online Platforms and Trading Software

Modern investors have access to a wide range of online platforms and trading software designed to facilitate mu stock investments. These tools offer real-time market data, advanced charting capabilities, and automated trading features.

Popular platforms such as Bloomberg Terminal and TD Ameritrade provide comprehensive resources for analyzing mu stock and executing trades efficiently.

Education and Networking Opportunities

Continuous learning and networking are vital for staying ahead in the mu stock market. Attending seminars, webinars, and industry conferences allows investors to gain valuable insights and connect with like-minded professionals.

Organizations such as the CFA Institute and the National Investor Relations Institute offer numerous resources and networking opportunities for mu stock enthusiasts.

Case Studies: Successful Mu Stock Investments

Real-World Examples and Lessons Learned

Examining real-world case studies provides practical insights into successful mu stock investments. By studying the strategies and decisions of experienced investors, newcomers can learn valuable lessons and improve their own investment approaches.

For instance, Warren Buffett's investment in a mu stock company yielded a 400% return over a five-year period, demonstrating the potential for significant gains in this sector.

Common Mistakes to Avoid

Understanding common mistakes made by mu stock investors can help prevent costly errors. Overtrading, emotional decision-making, and inadequate research are among the pitfalls that can hinder investment success.

By avoiding these mistakes and adhering to a disciplined investment strategy, investors can enhance their chances of achieving consistent returns in the mu stock market.

Conclusion and Call to Action

In conclusion, mu stock represents a dynamic and rewarding investment opportunity for those willing to invest time and effort into understanding its complexities. By following the strategies and insights outlined in this guide, you can position yourself for success in the mu stock market.

We invite you to share your thoughts and experiences in the comments section below. Additionally, consider exploring our other articles for more valuable information on financial markets and investment strategies. Together, let's build a stronger, more informed investment community.

Table of Contents

- Understanding Mu Stock: An Overview

- Key Factors Influencing Mu Stock Performance

- Investment Strategies for Mu Stock

- Analysis of Mu Stock Market Trends

- Key Metrics for Evaluating Mu Stock

- Challenges and Risks in Mu Stock Investment

- Tools and Resources for Mu Stock Investors

- Case Studies: Successful Mu Stock Investments

- Conclusion and Call to Action