Tax Day 2025: A Comprehensive Guide To Understanding Deadlines, Obligations, And Key Considerations

Mar 21 2025

Tax Day 2025 is a critical date for individuals and businesses alike as it marks the deadline for filing tax returns in the United States. Understanding the implications of this date is essential to ensure compliance with federal tax regulations and avoid penalties. Whether you're a first-time filer or an experienced taxpayer, being well-prepared is key to a smooth and stress-free filing process.

As the deadline approaches, many taxpayers find themselves overwhelmed by the complexities of tax regulations and the numerous documents required for submission. This article aims to provide a thorough guide to help you navigate the process effectively, ensuring that you meet all obligations while maximizing potential deductions and credits.

By delving into the specifics of Tax Day 2025, we'll explore key dates, important forms, strategies for minimizing tax liabilities, and resources available to assist you. Whether you're filing individually or through a business, this guide will serve as a valuable resource to streamline your tax preparation efforts.

Read also:Alekssecret Unveiling The Phenomenon Of Digital Marketing Mastery

Understanding Tax Day 2025

What is Tax Day?

Tax Day refers to the annual deadline by which individuals and businesses must file their federal income tax returns with the IRS. In 2025, Tax Day is scheduled for April 15th, unless it falls on a weekend or holiday, in which case it may be extended to the next business day. This deadline applies to all taxpayers, regardless of income level or filing status.

For many, Tax Day is a reminder of their financial obligations to the government and an opportunity to review their fiscal health. It's important to note that failing to file by the deadline can result in penalties, including late filing fees and interest on unpaid taxes.

Key Dates to Remember

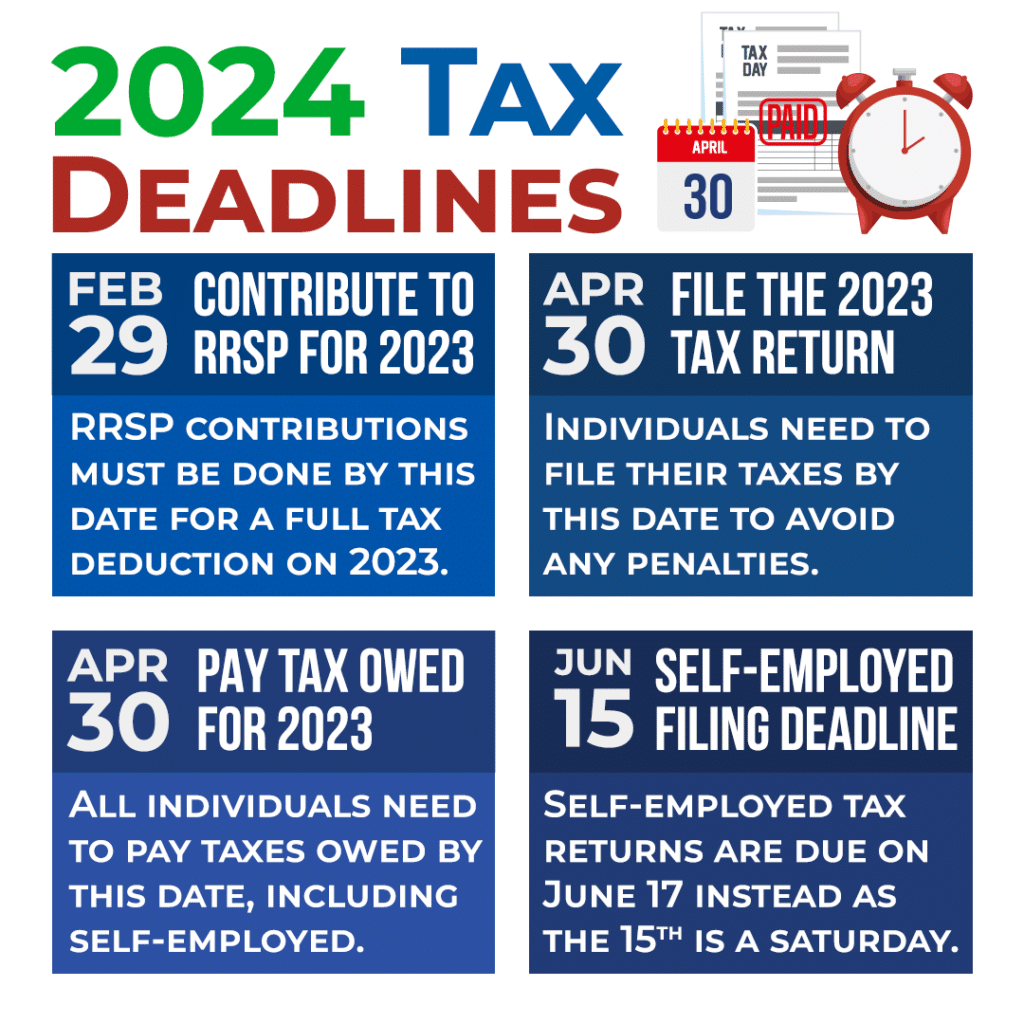

While April 15th is the primary deadline, there are several other important dates to consider:

- January 31st: Employers must distribute W-2 forms to employees.

- February 28th: Deadline for businesses to file Form 1099 for non-employee compensation.

- March 1st: Early filing period begins for certain taxpayers seeking refunds.

- April 15th: Final deadline for submitting individual tax returns.

Preparing for Tax Day 2025

Gathering Essential Documents

Before beginning the filing process, ensure you have all necessary documents at hand. These include:

- W-2 forms from employers

- 1099 forms for freelance or investment income

- Receipts for deductible expenses

- Previous year's tax return for reference

Having these documents organized will significantly simplify the filing process and reduce the risk of errors.

Selecting the Right Filing Status

Your filing status determines the tax rates and deductions applicable to your situation. Common filing statuses include:

Read also:Courtney Henggler The Rising Star In Hollywood

- Single

- Married Filing Jointly

- Head of Household

- Married Filing Separately

Choosing the correct status is crucial for optimizing your tax liability and maximizing available credits.

Strategies for Minimizing Tax Liabilities

Exploring Tax Deductions

Understanding available deductions can help reduce your taxable income. Common deductions include:

- Mortgage interest

- Charitable contributions

- Medical expenses exceeding 7.5% of AGI

- Student loan interest

Consulting with a tax professional or using tax preparation software can assist in identifying all applicable deductions.

Utilizing Tax Credits

Tax credits directly reduce the amount of tax owed and can be more beneficial than deductions. Examples include:

- Child Tax Credit

- American Opportunity Credit

- Energy Efficiency Credits

Ensure you qualify for these credits by reviewing IRS guidelines and providing necessary documentation.

Common Mistakes to Avoid

Incorrect Personal Information

Mistakes in personal details such as Social Security numbers or names can lead to processing delays. Always double-check this information before submitting your return.

Missing Documentation

Failure to include all required forms or supporting documents can result in your return being rejected. Keep a checklist of all necessary items to ensure completeness.

Resources for Tax Filers

IRS Website

The IRS website offers a wealth of information, including forms, instructions, and calculators to assist with tax preparation. Visit irs.gov for up-to-date resources.

Tax Preparation Software

Utilizing software like TurboTax or H&R Block can simplify the filing process by guiding you through each step and ensuring accuracy. These tools often include features to identify potential deductions and credits.

Understanding Tax Day Extensions

Requesting an Extension

If you're unable to file by the deadline, you can request an extension using Form 4868. This grants an additional six months to submit your return, though any taxes owed must still be paid by April 15th.

Penalties for Late Filing

Failing to file or pay taxes on time can result in penalties, including:

- Failure-to-file penalty: 5% of unpaid taxes per month, up to 25%

- Failure-to-pay penalty: 0.5% of unpaid taxes per month, up to 25%

Impact of Economic Factors on Tax Day 2025

Inflation Adjustments

Each year, tax brackets and deduction limits are adjusted for inflation to reflect changes in the cost of living. Stay informed about these adjustments to ensure accurate filing.

Tax Law Changes

Recent legislative changes may impact your tax obligations. Review updates from the IRS or consult with a tax advisor to remain compliant.

Supporting Small Businesses

Business Tax Deductions

Small business owners can take advantage of specific deductions, such as:

- Home office expenses

- Travel and mileage costs

- Business equipment purchases

Proper record-keeping is essential to substantiate these deductions.

Conclusion and Call to Action

Tax Day 2025 represents a crucial deadline for fulfilling your tax obligations and ensuring financial compliance. By understanding key dates, gathering necessary documents, and exploring available deductions and credits, you can streamline the filing process and minimize liabilities.

We encourage you to take action by reviewing your financial records, consulting with a tax professional if needed, and utilizing available resources to prepare your return. Share this article with others who may benefit from the information, and explore additional content on our website for further guidance on personal and business finance.

Table of Contents

- Understanding Tax Day 2025

- Preparing for Tax Day 2025

- Strategies for Minimizing Tax Liabilities

- Common Mistakes to Avoid

- Resources for Tax Filers

- Understanding Tax Day Extensions

- Impact of Economic Factors on Tax Day 2025

- Supporting Small Businesses

- Conclusion and Call to Action