From $500 To $5000: Millennials Are Watching Their Monthly Student Loan Payments Skyrocket Under Trump And Panicking On TikTok

Mar 22 2025

Millennials are facing unprecedented financial challenges as their student loan payments skyrocket under the Trump administration, with many turning to TikTok to express their growing anxiety. The rising cost of education combined with economic uncertainty has left many millennials struggling to manage their financial obligations. This has sparked a wave of discussions on social media, where young adults share their frustrations and seek support from their peers. The issue has become a trending topic, particularly on TikTok, where users are vocalizing their concerns.

Student loans have long been a contentious issue in the United States. For millennials, the burden of these loans has increased dramatically over the past few years, with many facing payments that exceed their initial estimates. The policies implemented during the Trump era have exacerbated the problem, leaving borrowers in a precarious financial situation. As a result, the conversation around student debt has moved beyond private discussions and into the public sphere, gaining traction on platforms like TikTok.

The financial strain caused by rising student loan payments is not just a personal issue but a societal one. It affects millennials' ability to save for the future, buy homes, and even start families. This article delves into the reasons behind the skyrocketing payments, the impact on millennials, and how they are using TikTok to cope with this growing crisis. Let's explore the issue in detail, along with potential solutions and expert insights.

Read also:Tammy Bruces Wife Unveiling The Life And Legacy Of A Controversial Figure

Table of Contents

- Understanding the Student Loan Crisis

- The Trump Administration's Impact on Student Loans

- Why Millennials Are Struggling

- The Role of TikTok in Raising Awareness

- The Economic Implications of Rising Student Debt

- How Millennials Are Coping

- Solutions to Address the Crisis

- Expert Opinions and Analysis

- Comparing Student Loan Policies Across Administrations

- Conclusion and Call to Action

Understanding the Student Loan Crisis

The student loan crisis is not a new phenomenon, but its impact has intensified in recent years. Millions of Americans are burdened by student debt, with outstanding loans totaling over $1.7 trillion as of 2023. For millennials, who entered the workforce during or after the 2008 financial crisis, the situation is particularly dire. Many took out loans to pursue higher education, hoping it would lead to better job prospects. However, the reality has been far different.

Factors Contributing to the Crisis

- Rising Tuition Costs: College tuition has increased significantly over the past few decades, outpacing inflation and wage growth.

- Economic Downturns: Economic recessions have made it harder for graduates to secure well-paying jobs, leaving them unable to repay their loans.

- Policy Changes: Changes in federal loan policies have made it more challenging for borrowers to manage their debt.

Data from the Federal Reserve shows that the average student loan debt for millennials is approximately $30,000. However, for those with graduate degrees or those attending private institutions, this figure can exceed $100,000. The burden of these loans has a ripple effect on the economy, as millennials delay major life milestones due to financial constraints.

The Trump Administration's Impact on Student Loans

Under the Trump administration, several policies were implemented that directly affected student loan borrowers. While some measures aimed to provide relief, others made it more challenging for borrowers to manage their debt. One of the most significant changes was the suspension of the Public Service Loan Forgiveness (PSLF) program, which many public sector employees relied on to reduce their loan balances.

Key Policy Changes

- Interest Rate Adjustments: The administration introduced changes to interest rates, making loans more expensive for new borrowers.

- Repayment Plan Modifications: Changes to income-driven repayment plans made it harder for some borrowers to qualify for reduced payments.

- Borrower Defense Rule: The rollback of the Borrower Defense Rule made it more difficult for students defrauded by for-profit colleges to have their loans discharged.

These changes have contributed to the skyrocketing monthly payments that many millennials are now facing. For instance, borrowers who initially expected to pay $500 per month may now face payments closer to $5,000, depending on their loan balance and repayment plan.

Why Millennials Are Struggling

Millennials are uniquely affected by the student loan crisis due to a combination of factors. Unlike previous generations, millennials entered the workforce during a period of economic uncertainty, making it harder to secure stable, high-paying jobs. Additionally, the cost of living has increased significantly, leaving many millennials struggling to make ends meet.

Read also:Matthew Jay Povich Net Worth Unveiling The Wealth Of A Rising Star

Key Challenges Faced by Millennials

- High Cost of Living: Rent, healthcare, and other essential expenses have risen faster than wages, leaving millennials with little disposable income.

- Job Market Competition: The job market is highly competitive, with many graduates competing for a limited number of positions.

- Lack of Financial Literacy: Many millennials lack the financial knowledge needed to manage their debt effectively, leading to poor decision-making.

These challenges, combined with the rising cost of student loans, have created a perfect storm of financial stress for millennials. Many are finding it difficult to balance their loan payments with other financial obligations, leading to increased anxiety and stress.

The Role of TikTok in Raising Awareness

TikTok has emerged as a powerful platform for millennials to voice their concerns about student loan debt. The app's short-form video format allows users to share their stories in a relatable and engaging way. Many TikTok users are using the platform to highlight the absurdity of their loan payments, often employing humor to convey their frustration.

How TikTok Is Changing the Conversation

- Community Building: TikTok has created a sense of community among millennials, allowing them to share their experiences and offer support to one another.

- Raising Awareness: By sharing their stories, TikTok users are bringing attention to the student loan crisis and advocating for policy changes.

- Creative Expression: TikTok's creative tools enable users to express their feelings in unique and memorable ways, making their messages more impactful.

One popular TikTok trend involves users creating videos that compare their monthly student loan payments to other expenses, such as rent or groceries. These videos often go viral, sparking discussions about the unfairness of the current system and the need for reform.

The Economic Implications of Rising Student Debt

The rising cost of student loans has significant economic implications, affecting not only millennials but the broader economy as well. With millions of Americans burdened by debt, consumer spending is likely to decrease, impacting industries such as real estate, retail, and travel. Additionally, the inability to save for retirement or invest in the stock market further exacerbates the problem.

Economic Impact on Millennials

- Delayed Homeownership: Many millennials are unable to save for a down payment due to their student loan obligations, leading to a decline in homeownership rates.

- Reduced Consumer Spending: High monthly payments leave millennials with little disposable income, reducing their ability to contribute to the economy.

- Impact on Retirement Savings: The burden of student loans makes it difficult for millennials to save for retirement, potentially leading to financial insecurity later in life.

These economic implications highlight the urgent need for policy changes that address the root causes of the student loan crisis. Without intervention, the problem is likely to worsen, further straining the economy and millennials' financial well-being.

How Millennials Are Coping

In response to the rising cost of student loans, many millennials are taking proactive steps to manage their debt. Some are exploring alternative repayment plans, while others are seeking financial advice to develop a repayment strategy that works for them. Additionally, the rise of financial literacy resources has empowered millennials to take control of their financial futures.

Strategies for Managing Student Loan Debt

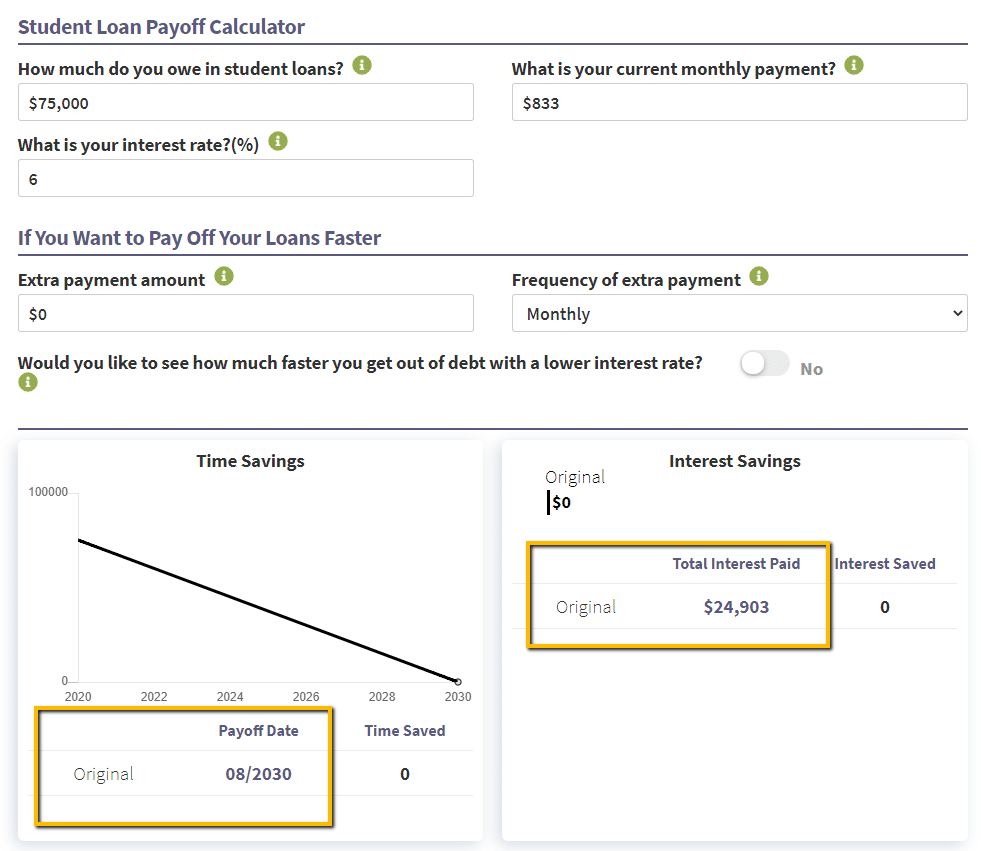

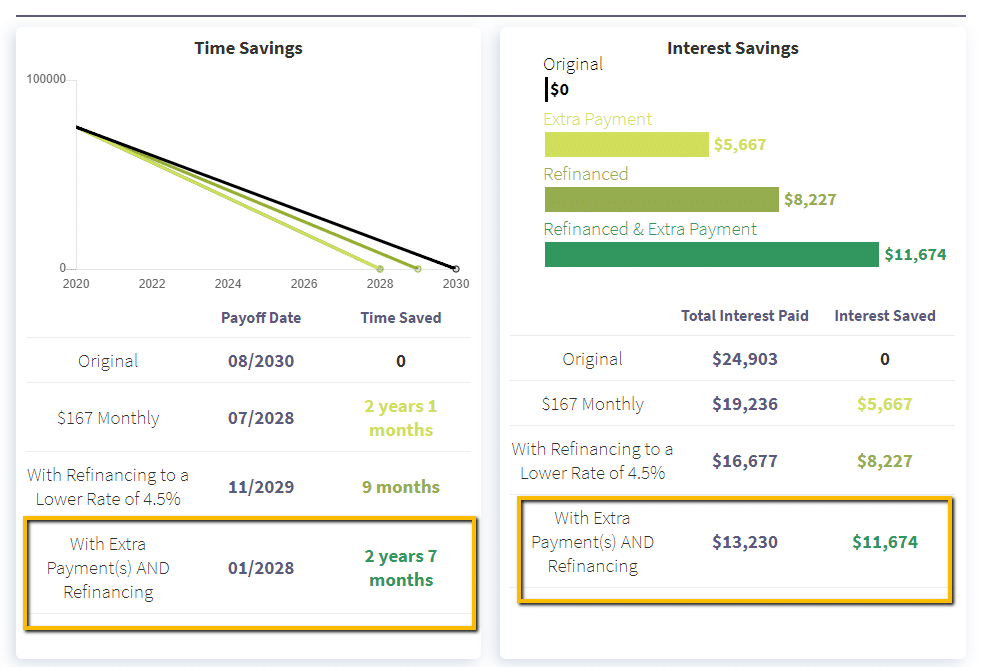

- Income-Driven Repayment Plans: These plans adjust monthly payments based on income, making them more manageable for borrowers.

- Loan Consolidation: Consolidating multiple loans into a single payment can simplify the repayment process and reduce interest rates.

- Financial Counseling: Seeking advice from financial experts can help borrowers develop a personalized plan to manage their debt.

While these strategies can help alleviate the burden of student loans, they are not a long-term solution. Systemic changes are needed to address the root causes of the crisis and ensure that future generations do not face the same challenges.

Solutions to Address the Crisis

Addressing the student loan crisis requires a multifaceted approach that involves both policy changes and individual action. Policymakers must work to create a more equitable system that reduces the burden on borrowers, while individuals must take steps to manage their debt effectively.

Potential Solutions

- Debt Forgiveness Programs: Expanding programs like PSLF and introducing new forgiveness initiatives could provide much-needed relief for borrowers.

- Tuition Freeze: Capping tuition increases at public universities could make higher education more affordable for future students.

- Improved Financial Education: Increasing access to financial literacy resources could empower students to make informed decisions about borrowing.

Implementing these solutions will require collaboration between government agencies, educational institutions, and financial experts. While the process may take time, the potential benefits for both millennials and the broader economy make it a worthwhile endeavor.

Expert Opinions and Analysis

Experts in the field of economics and education have weighed in on the student loan crisis, offering insights into its causes and potential solutions. Many agree that the problem is complex and requires a comprehensive approach to address effectively.

Expert Perspectives

- Economic Analysts: According to a report by the Brookings Institution, student loan debt is a major contributor to wealth inequality in the United States.

- Education Experts: The National Association of Student Financial Aid Administrators (NASFAA) has called for increased funding for Pell Grants to help low-income students manage their debt.

- Policy Makers: Members of Congress have proposed legislation aimed at reducing the burden of student loans, including measures to lower interest rates and expand forgiveness programs.

These expert opinions underscore the importance of addressing the student loan crisis and highlight the need for immediate action.

Comparing Student Loan Policies Across Administrations

Student loan policies have varied significantly across administrations, with each administration implementing its own approach to addressing the issue. While some policies have provided relief to borrowers, others have made the problem worse. Comparing these policies can help shed light on the most effective strategies for managing student debt.

Key Differences in Policies

- Obama Administration: Introduced income-driven repayment plans and expanded the PSLF program, providing much-needed relief for borrowers.

- Trump Administration: Rolled back some borrower protections and made it more difficult for students to qualify for loan forgiveness.

- Biden Administration: Proposed a $10,000 student loan forgiveness plan and reinstated some protections for borrowers.

Understanding the differences in these policies can help inform future policy decisions and ensure that borrowers receive the support they need.

Conclusion and Call to Action

The student loan crisis is a pressing issue that affects millions of millennials across the United States. Rising payments, coupled with economic uncertainty, have left many struggling to manage their financial obligations. The role of platforms like TikTok in raising awareness and fostering community cannot be overstated, as they provide a space for millennials to share their experiences and advocate for change.

To address this crisis, policymakers must work together to implement solutions that reduce the burden on borrowers and ensure that higher education remains accessible to all. Individuals, too, must take steps to manage their debt effectively and advocate for policies that prioritize their financial well-being.